Planning your finances

Everyone wants to have enough money to live comfortably, but also to realize higher goals, desires or aspirations - education, travel, gifts, money for retirement, health insurance, etc. To realize these goals, you need to plan your finances - it's not enough to live "from today to tomorrow".

Why invest?

-

You can earn higher returns than saving money in bank deposits, despite fluctuations in financial markets

-

Strengthen your capital and reach your personal long-term savings goals

-

Protect your capital against inflation or negative interest rates

Before you invest

Everyone's savings goals change throughout their lives. You can save money for a car, a home, an exotic vacation, your children's education or retirement.

Before you make an investment, start by analyzing your current situation and answer the following questions for yourself:

- What are my monthly expenses? Make a list of all the expenses that may arise in a month: recurring expenses (utility bills, food, household, insurance, etc.) and set aside a sum for any extraordinary expenses!

- How much can I save, month by month? What do I want to save for?

- Where do I want to be financially in 5, 10, 20 years? What do I want to achieve and in what time frame?

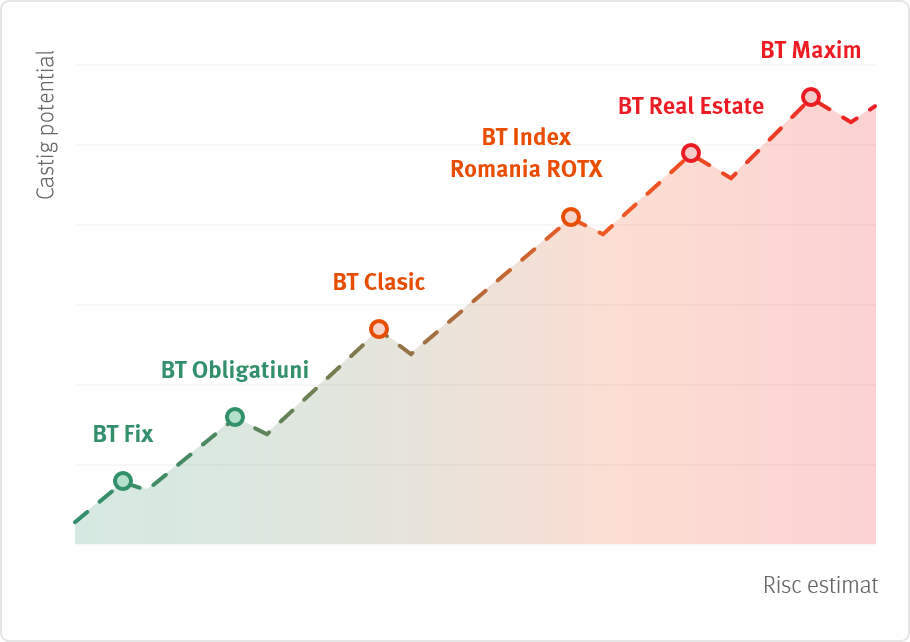

BT Asset Management offers clients a wide range of investment funds, with very different degrees of risk and potential returns - from bond or fixed income funds, to funds investing in Romanian, European Union or third country equities, including thematic funds (agro, energy, real estate, technology), in LEI, EURO or USD.

Access to open-end investment funds is available to clients through:

Transilvania Bank

Access to the 14 open-end investment funds is available to clients:

- 100% online through the BT Pay app, Investment section

- through the BT branch network, and after the first purchase, online through the BT Pay and BT Go (Legal Entity) apps – making the investment process much simpler.

Salt Bank

- A total of 4 open-end investment funds can be accessed 100% online through the Salt app. The funds distributed through Salt Bank are BT Obligațiuni, BT Euro Obligațiuni, BT Index Romania ROTX and BT Technology.

Alternative investment funds are distributed exclusively through BT Asset Management.

BT Energy

Open-ended investment fund in EUR - minimum 75% of the assets are represented by shares traded on European markets of energy-related companies.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Agro

Open-ended investment fund in EUR - at least 75% of the assets are represented by shares traded on European markets of companies related to agriculture and food.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Technology

Open-ended investment fund in EUR - minimum 75% of assets are represented by shares traded on European markets of companies related to the information sector.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Real Estate

Open-ended investment fund in EUR - minimum 75% of the assets are represented by shares traded on European markets of real estate related companies.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Index Romania ROTX

Equity fund replicating a stock index in RON (ROTX - Romanian Traded Index).

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Maxim

Open-ended RON investment fund - minimum 85% of assets are represented by shares traded on the Bucharest Stock Exchange.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Index Austria ATX

Equity fund replicating a stock index in EUR (ATX - Austrian Traded Index).

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 5 years

BT Invest

Alternative investment fund investing in securities and money market instruments listed or traded on a trading venue in Romania, a Member State or a third country.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 2 years

BT Clasic

Diversified RON fund, predominantly in fixed income financial instruments. A maximum of 40% of assets may be invested in equities or other risky financial instruments.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 3 years

BT Euro Clasic

Diversified EUR fund, predominantly in fixed income financial instruments. A maximum of 40% of assets may be invested in equities or other risky financial instruments.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 3 years

BT Obligatiuni

RON fixed income fund - predominantly in corporate bonds and bank deposits.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 3 years

BT Euro Obligatiuni

EUR fixed income fund - predominantly in corporate and government/municipal bonds.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 3 years

BT Dolar Fix

Fund of fixed income instruments in USD - predominantly in bank deposits.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 6 months

BT Euro Fix

Fund of fixed income instruments in EUR - predominantly in bank deposits.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 6 months

BT Fix

RON fixed income fund - predominantly in bank deposits.

Summary risk indicator

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Recommended period: minimum 6 months